In a country like India, where economic uncertainties coexist with familial responsibilities, having a robust emergency fund isn’t just smart—it’s essential. From unplanned medical expenses in a Tier-2 city to sudden job loss in a metro, emergencies don’t knock before arriving. The real question is: how much emergency fund should I have to face life without financial fear?

What Is an Emergency Fund?

An emergency fund is a reserve of cash or liquid assets specifically meant to cover unforeseen events. It’s not a mutual fund, nor your Diwali shopping budget—it’s your personal safety net.

Why an Emergency Fund Is Non-Negotiable

In India, most households lean heavily on a single income. Whether you’re a software engineer in Bangalore or a small business owner in Surat, a single financial mishap can derail years of progress. Without a financial cushion, families often fall into debt traps or rely on gold loans and personal borrowings.

How an Emergency Fund Differs from Savings

While savings are often linked to goals—like a Goa vacation or your child’s iPad—an emergency fund has only one purpose: to shield you from financial shocks. It must remain untouched until a genuine emergency arises.

Common Financial Emergencies That Justify a Fund

- Layoffs or salary cuts (especially during economic downturns like COVID-19)

- Hospitalisation due to illness or accidents (even with insurance, out-of-pocket costs can be high)

- Sudden repairs—like a broken geyser during a Delhi winter

- Family emergencies requiring travel, especially for NRIs or those from rural towns

- Legal issues or business shutdowns

The Golden Rule: 3 to 6 Months of Expenses

So, how much emergency fund should I have?

The classic recommendation is to set aside 3 to 6 months of essential living expenses. This includes rent, groceries, EMIs, school fees, insurance premiums, and utility bills. For instance, if your monthly outgo is ₹50,000, your fund should be ₹1.5–3 lakhs.

Factors That Influence Emergency Fund Size

Job Stability

A permanent employee at Infosys may need a smaller fund compared to a contract worker or a startup employee.

Number of Dependents

Supporting aging parents in Patna or funding your child’s education in Mumbai? Your fund must reflect these responsibilities.

Health Conditions

Frequent visits to private hospitals or managing chronic illnesses like diabetes mean you should factor higher medical contingencies.

Income Sources

If you earn from multiple avenues—say, salary + side gig—your emergency fund could be leaner. Sole earners should aim bigger.

Debt Obligations

Ongoing car loans, home loans, or education EMIs? You need extra padding in your fund to continue payments without defaulting.

Emergency Fund for Freelancers and Gig Workers in India

If you’re a freelancer on Upwork or a Zomato delivery partner, income can be erratic. Aim for at least 6 to 12 months of expenses. Also, consider that client payments can be delayed, especially across borders.

Emergency Fund for Dual-Income Households

A family in Pune with both spouses working at IT firms has some cushion. However, in times of recession or layoffs, both may be affected. Keeping 3–4 months of expenses per earner is still advisable.

Emergency Fund for Single-Income Families

A teacher in Indore supporting three family members should consider a full 6-month emergency fund as a minimum. The lack of a backup income makes this non-negotiable.

Emergency Fund for Retirees

Retired individuals, especially those without a regular pension, need at least 6–12 months of living expenses. With medical costs on the rise, this can save you from prematurely breaking FDs or selling property.

Calculating Your Monthly Expenses Accurately

Fixed vs. Variable Costs

Start by identifying all fixed expenses—house rent, tuition fees, insurance premiums. Then add variable but essential costs—groceries, petrol, medicines.

Essential vs. Discretionary Spending

Netflix, Zomato, and weekend trips to Lonavala? Nice-to-haves. Not emergencies. Only include essentials in your emergency fund math.

Where to Keep Your Emergency Fund

High-Yield Savings Account

Banks like IDFC FIRST, Equitas, or AU Small Finance Bank offer 6–7% interest on savings. These accounts are safe, liquid, and easy to access.

Money Market Funds

Consider ultra short-term debt mutual funds with low risk. Suitable if you can tolerate slight fluctuations but want better returns.

Short-Term Fixed Deposits

Split your fund into 3–6 month FDs for slightly higher interest. But ensure premature withdrawal is possible without penalties.

Use tools like the HDFC Emergency Fund Calculator to determine how much you should save based on your actual expenses.

What Not to Do With Your Emergency Fund

Don’t Invest in the Stock Market

Equity is not emergency-friendly. A market crash can wipe out value when you need money the most.

Don’t Use It for Planned Events

Buying a car during a Diwali sale or paying for a cousin’s wedding in Jaipur is not an emergency. Keep the sanctity of the fund intact.

How to Build an Emergency Fund From Scratch

Set a Realistic Target

Start with a goal of ₹25,000 or ₹50,000. Even one month’s rent can make a difference during a crisis.

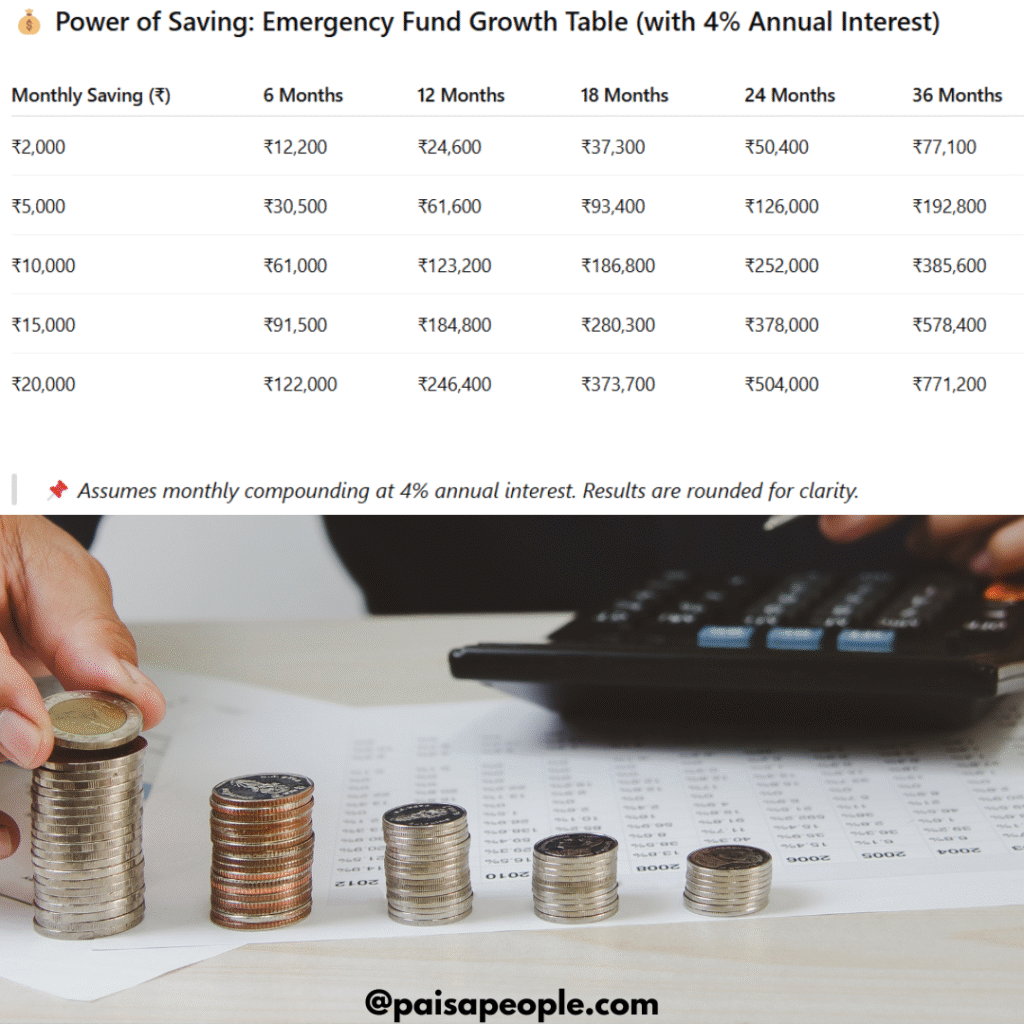

Automate Monthly Transfers

Auto-transfer ₹5,000–₹10,000 every month into a separate account. It becomes easier to accumulate without thinking.

Reduce Lifestyle Inflation

Cut down on non-essentials—less Swiggy, fewer impulse purchases. Redirect those savings into your emergency kitty.

Replenishing Your Emergency Fund After Use

Used your fund for a surgery or home repair? Refill it immediately. Use your bonus, tax refund, or annual increment for this purpose.

Emergency Fund vs. Credit Cards: A Dangerous Comparison

Credit cards seem like a lifeline—but they carry 36–42% annual interest. Don’t fall into the trap of financing emergencies with debt. Your emergency fund is your best alternative to financial slavery.

Psychological Peace: The Intangible Benefit

Having ₹2 lakhs set aside, untouched and ready, gives unmatched peace of mind. It reduces panic during emergencies and gives you space to think clearly and act decisively.

Adjusting Your Emergency Fund Over Time

Life evolves—marriage, kids, relocation, job changes. Review your emergency fund annually. If your expenses go up, your buffer should too.

Final Thoughts

So, how much emergency fund should I have? The answer lies in your lifestyle, obligations, and risk exposure. In India, where unexpected expenses are a part of life, having 3–6 months of expenses tucked away isn’t just good financial hygiene—it’s survival insurance. Start today, one month at a time. Your future self—and your family—will thank you for it.

For more precision, use a tool like the Standard Chartered Emergency Calculator to personalise your goals today.

2 thoughts on “How Much Emergency Fund Should I Have”