American Express (AmEx) is one of the most prestigious credit card brands worldwide, offering a wide range of cards with exclusive benefits. In India, many people aspire to get an American Express card due to its premium offerings like reward points, airport lounge access, and other unique perks. But how do you actually go about getting an American Express card in India? This guide covers everything you need to know—from eligibility criteria and the application process to card benefits and tips for approval. Whether you’re a first-time applicant or someone looking to upgrade, read on to find out how to get American Express card in India.

Introduction to American Express Cards

What is American Express?

American Express, or AmEx, is an American multinational financial services company that is known for issuing premium credit cards, charge cards, and traveler’s cheques. Founded in 1850, the company has become synonymous with high-end credit products and exceptional customer service. If you’re wondering how to get an American Express card in India, it’s important to understand the brand’s legacy and the benefits associated with their cards.

Why Choose American Express in India?

In India, American Express cards offer a variety of benefits, including exclusive discounts, rewards points, airport lounge access, and premium customer service. AmEx is particularly attractive to frequent travelers and those who value luxury services and rewards for their spending. Knowing how to get an American Express card in India could unlock a new world of opportunities in terms of credit rewards and global benefits.

Types of American Express Cards Available in India

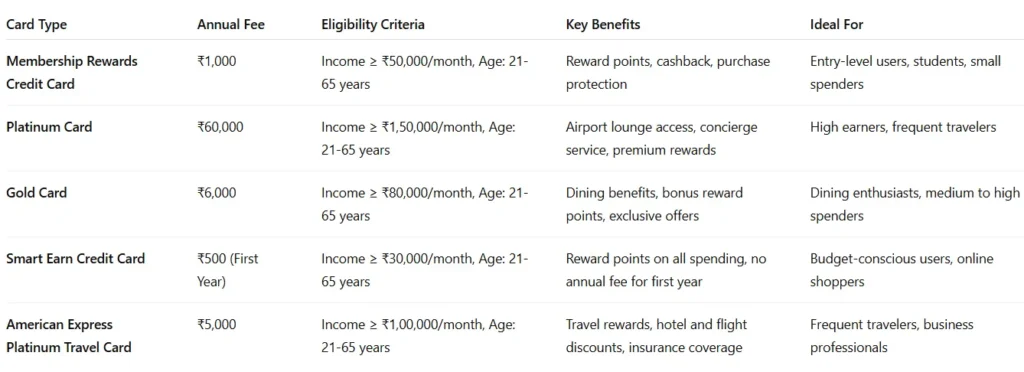

AmEx offers several credit card options, each with its own set of features and benefits. Here’s a look at some of the most popular ones:

- American Express Membership Rewards Credit Card: A great entry-level card for earning rewards points.

- American Express Platinum Card: A premium card with access to airport lounges and high-value rewards.

- American Express Gold Card: Popular among individuals who enjoy dining benefits and reward points.

- American Express Smart Earn Credit Card: Ideal for people looking for a straightforward, no-frills rewards card.

Eligibility Criteria for Getting an American Express Card in India

Minimum Income Requirements

To apply for an American Express card in India, applicants generally need to have a minimum income of ₹50,000 per month. For premium cards like the Platinum Card, this requirement could go up to ₹1,50,000 or higher. When considering how to get an American Express card in India, it’s crucial to ensure that you meet the income threshold.

Age and Employment Status

You must be at least 21 years old and below 65 years to apply. Applicants should be employed or self-employed, with a stable source of income. These factors play a role in how to get an American Express card in India.

Credit Score and Financial History

A good credit score (usually 750 or above) is crucial for a successful application. American Express looks for individuals with a strong financial history, as this reflects their ability to manage credit responsibly. If you’re wondering how to get your American Express card in India, keep in mind that a clean credit history will greatly improve your chances.

Documentation Required for Application

To apply, you will need to submit the following documents:

- Proof of identity (Aadhar card, passport, or voter ID)

- Proof of income (salary slips, bank statements)

- Proof of address (utility bill, rental agreement, or passport)

Step-by-Step Process to Apply for an American Express Card in India

Online Application Process

- Visit the American Express website: Go to the official AmEx India website and choose the card that suits you best.

- Fill out the application form: Provide your personal details, income information, and contact details.

- Submit necessary documents: Upload scanned copies of the required documents.

- Wait for approval: Once submitted, American Express will assess your eligibility. If your application is approved, you will receive your card within 7-10 business days.

Offline Application Process

If you prefer, you can also apply offline by visiting a nearby branch or calling AmEx’s customer service. In this case, you’ll need to fill out a physical application form and provide physical copies of the required documents.

How to Track Your Application Status

You can track your application status by logging into your account on the American Express website or by calling customer support. This is one of the simplest ways to check how to get your American Express card in India and stay updated on your application.

American Express Card Fees and Charges

Joining Fees and Annual Charges

Most American Express cards have an annual fee, which varies depending on the card type. For example, the Membership Rewards Card has a joining fee of ₹1,000, while the Platinum Card comes with a joining fee of ₹60,000 or more. This is important to consider when figuring out how to get an American Express card in India and what costs you should be prepared for.

Late Payment and Over-limit Fees

Late payment fees typically range from ₹500 to ₹1,500 depending on the amount overdue. Over-limit fees can also be applied if you exceed your credit limit. Understanding these fees will help you manage your card better once you know how to get an American Express card in India.

Foreign Currency Markup

American Express charges a foreign currency markup fee of around 3.5% on transactions made in foreign currencies.

Other Charges to Be Aware Of

- Cash withdrawal fee: 2.5% or ₹500, whichever is higher.

- Balance transfer fee: 1.5% of the transferred amount.

American Express Card Benefits in India

Rewards Points and Cashback

American Express cards are known for offering excellent rewards programs. Cardholders can earn points for every rupee spent, which can be redeemed for travel, merchandise, or even statement credit. Premium cards like the Platinum Card offer higher reward rates. Understanding how to get an American Express card in India means learning how to use the rewards points for maximum value.

Airport Lounge Access

AmEx provides access to exclusive airport lounges around the world, which is a major benefit for frequent flyers. The Platinum Card, in particular, offers access to over 1,000 lounges globally. If you’re an avid traveler, this is a key reason how to get an American Express card in India could enhance your travel experience.

Exclusive Offers and Discounts

American Express cardholders often get access to special discounts at partner brands, as well as early access to sales and events.

Insurance Benefits

Many AmEx cards offer travel insurance, including trip cancellation, lost baggage, and emergency medical coverage, making them ideal for frequent travelers.

Global Acceptance and Support

American Express cards are accepted worldwide and come with 24/7 customer support.

Tips to Increase Your Chances of Getting Approved for an American Express Card in India

Improving Your Credit Score

A higher credit score improves your chances of getting an American Express card in India. Ensure that your credit utilization is low, and pay off any outstanding debts. This step will go a long way in ensuring you meet the credit score criteria.

Ensuring Your Income Meets the Threshold

If your income is lower than the requirement for the card you’re interested in, consider applying for a lower-tier card like the Membership Rewards Credit Card. This card has a more accessible income requirement and is a great starting point in learning how to get an American Express card in India.

Addressing Application Errors

Double-check your application form to ensure that all the information is accurate. Errors can delay the process or even lead to rejection, which could hinder your chances of getting an American Express card in India.

Understanding American Express’ Approval Process

American Express typically reviews your income, credit score, and financial history before approving your application. Ensure that all documents are in order for a smooth process.

Common Myths About Getting an American Express Card in India

Myth 1: Only High-Income Individuals Can Get AmEx Cards

While AmEx offers premium cards for high-income individuals, they also have entry-level cards for people with moderate incomes. So, getting an American Express card in India is possible for a wider range of applicants.

Myth 2: American Express Cards Aren’t Accepted Everywhere

While not as widely accepted as Visa and MasterCard, American Express cards are accepted at most high-end retailers and travel providers in India.

Myth 3: American Express Cards Have Extremely High Fees

While some AmEx cards do have higher fees, the benefits often outweigh the costs for frequent users. Lower-tier cards come with more reasonable fees.

Myth 4: Only US Residents Can Apply for American Express Cards

This is false. American Express is available in many countries, including India, and residents can apply for cards based on eligibility criteria.

American Express vs Other Credit Cards in India

Benefits of American Express Cards

Compared to other credit

cards, American Express offers superior customer service, rewards programs, and exclusive perks for cardholders. Whether you’re wondering how to get American Express card in India or looking for alternatives, AmEx’s offerings often stand out.

Why Choose American Express Over Visa/Mastercard

Visa and Mastercard are widely accepted, but American Express often provides more luxurious perks, which is a key selling point for those who travel often or enjoy premium rewards.

Quick Takeaways

- To get an American Express card in India, ensure you meet the income and credit score requirements.

- Follow the online or offline application process and ensure all documents are in order.

- Be aware of the joining fees, annual charges, and other fees associated with the card.

- Maximize rewards by using the American Express card for everyday purchases and big-ticket items.

- Improve your chances of approval by having a high credit score and stable income.

Conclusion

In conclusion, getting an American Express card in India opens up a wide range of benefits and perks that can improve your financial life. From excellent rewards points to exclusive access to lounges, American Express cards cater to those who want more than just a basic credit card. By understanding the eligibility criteria, application process, fees, and benefits, you can make an informed decision and enjoy the luxury that comes with being an American Express cardholder in India. Ready to apply? Take the first step and apply today!

Frequently Asked Questions

- What are the income requirements to get an American Express card in India?

- To qualify for an American Express card in India, your monthly income should be at least ₹50,000, with premium cards requiring higher income levels.

- Can I apply for an American Express card if I have a low credit score?

- While a low credit score may decrease your chances, American Express may still approve your application if you meet other criteria.

- What are the benefits of getting an American Express card in India?

- Benefits include rewards points, airport lounge access, insurance, and exclusive offers from partner brands.

- Is American Express widely accepted in India?

- While it’s not as widely accepted as Visa or MasterCard, American Express cards are accepted at many high-end retailers, hotels, and travel service providers in India.

- How do I check the status of my American Express card application in India?

- You can check your application status online or by contacting American Express customer support.