In an age where students are becoming more financially aware, creating passive income is no longer a distant dream. From savings accounts to skill-based rewards, the Indian government offers numerous schemes tailored to help young citizens, especially students, build financial independence early. In this article, we explore how to earn passive income from govt schemes in India for students—a practical, beginner-friendly guide with actionable steps.

Understanding Passive Income

Passive income refers to earnings derived from ventures in which a person is not actively involved. For students, this means earning money through investments, government schemes, or businesses that require minimal day-to-day effort.

Top Government Schemes for Students to Earn Passive Income

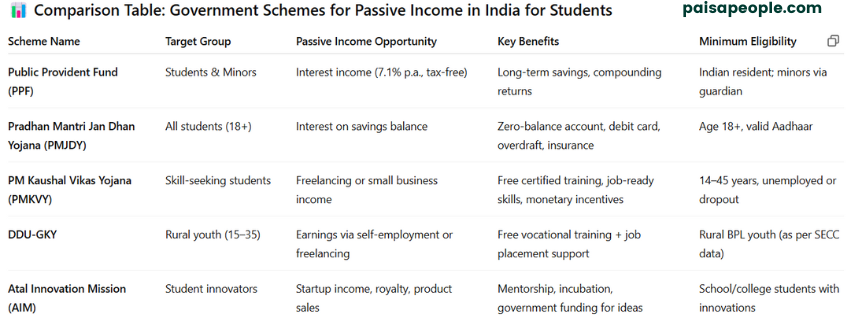

1. Public Provident Fund (PPF)

The Public Provident Fund is a long-term investment scheme backed by the Indian government. Students can open a PPF account with a minimum deposit of ₹500. The current interest rate is 7.1% per annum, compounded annually. The maturity period is 15 years, and the interest earned is tax-free. This makes PPF an excellent option for students looking to invest small amounts regularly and earn passive income over time.

2. Pradhan Mantri Jan Dhan Yojana (PMJDY)

PMJDY is a financial inclusion scheme that aims to provide every Indian citizen with access to financial services. Students can open a zero-balance savings account under this scheme. The account comes with benefits like a RuPay debit card, insurance cover, and access to overdraft facilities. By maintaining a balance and using the account regularly, students can earn interest and avail of other financial benefits.

3. Pradhan Mantri Kaushal Vikas Yojana (PMKVY)

PMKVY is a skill development initiative that offers free training to students in various sectors. Upon successful completion, students receive a certificate and a monetary reward. While the primary goal is skill enhancement, students can leverage these skills to start small businesses or freelance, generating passive income streams.

4. Deen Dayal Upadhyaya Grameen Kaushalya Yojana (DDU-GKY)

DDU-GKY focuses on providing skill development training to rural youth. Students can enroll in various courses and, upon completion, receive placement assistance. The skills acquired can help students start their own ventures or work as freelancers, earning passive income.

5. Atal Innovation Mission (AIM)

AIM promotes innovation and entrepreneurship among students. Through its Atal Tinkering Labs and Incubation Centers, students can develop their ideas into startups. The mission provides mentorship, funding, and resources to help students turn their innovative ideas into profitable ventures, leading to passive income opportunities.

How Students Can Leverage These Schemes

- Start Small Investments: Open a PPF or PMJDY account and make regular deposits. Over time, the interest accumulated can serve as passive income.

- Skill Development: Enroll in courses under PMKVY or DDU-GKY. Use the skills acquired to offer services online or start a small business.

- Innovate and Create: Participate in AIM’s programs to develop innovative solutions. Monetize these solutions through apps, websites, or products.

- Financial Planning: Utilize the financial services offered under PMJDY to manage and grow your savings.

Tips for Maximizing Passive Income

- Consistency is Key: Regularly contribute to your PPF account or any other investment scheme.

- Build a Safety Net First: Before diving fully into passive income strategies, it’s smart to ensure you have a financial cushion. Learn more about how much emergency fund you should have to protect yourself from unexpected expenses.

- Stay Updated: Keep an eye on new government schemes and opportunities that can help you earn passive income.

- Diversify: Don’t rely on a single source. Explore multiple schemes and avenues to maximize your earnings.

- Educate Yourself: Understand the terms and conditions of each scheme to make informed decisions.

Conclusion

The Indian government offers a plethora of schemes that can help students generate passive income. By leveraging these opportunities, students can not only earn money but also gain valuable skills and experience. It’s essential to stay informed and proactive to make the most of these schemes and pave the way for financial independence.

FAQs

Q1: Can students under 18 open a PPF account?

Yes, minors can open a PPF account with a guardian acting as the custodian.(Wikipedia)

Q2: How can I enroll in PMKVY?

Visit the official PMKVY website and find training centers near you.(Wikipedia)

Q3: Is there any cost associated with DDU-GKY?

No, the training under DDU-GKY is free of cost.(Wikipedia)

Q4: How can I apply for a loan under Stand-Up India?

Eligible students can approach the nearest bank branch that offers loans under the Stand-Up India scheme.(Wikipedia)

Q5: What are the benefits of PMJDY?

PMJDY offers benefits like a zero-balance savings account, RuPay debit card, insurance cover, and access to overdraft facilities.(Wikipedia)

2 thoughts on “Passive Income from Government Schemes in India for Students”